Businesses often forget that increasing your revenues means you also increase your expenses. It’s only natural. As your sales go up, so does your cost of goods sold (COGS). For services, that would be your cost of sales. And that’s only considering the variable expenses. We’re not even talking about fixed expenses. At a certain point, this will also increase. But that’s for another time.

In my previous article, I talked about the only formula you need to run your business — also known as the profitability framework. I showed the relationships between profits, revenues, and expenses. Here, I’ll focus on the revenues.

What Are Revenues or Sales

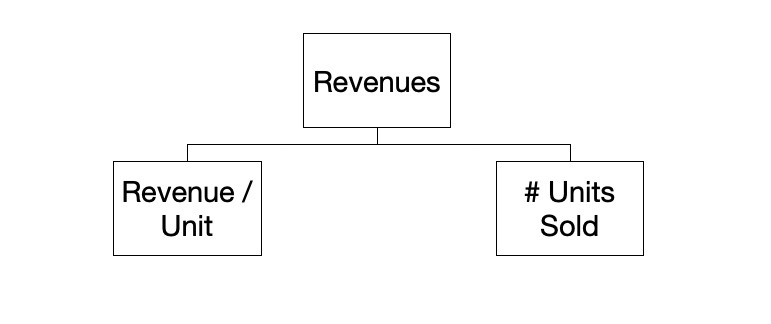

Revenues, or sales, is the product of price and quantity sold over a period of time. Another term for the price is unit price or price/revenue per unit.

Revenues = Price x Quantity

There are only 3 options to increase your sales:

- Increase your price

- Increase the quantity sold; or

- A combination of both

Those are the only 3 ways you can do so. It’s mathematically impossible to increase your revenues unless they don’t fall under these categories.

How to Increase Revenues

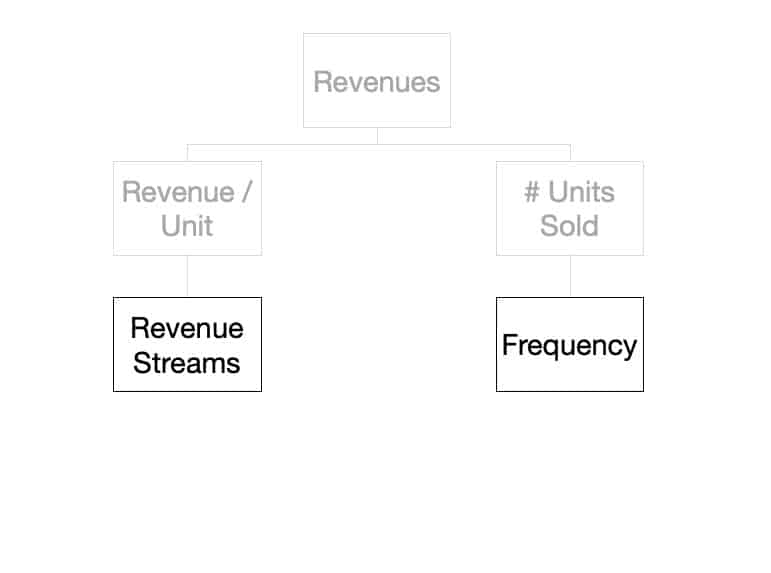

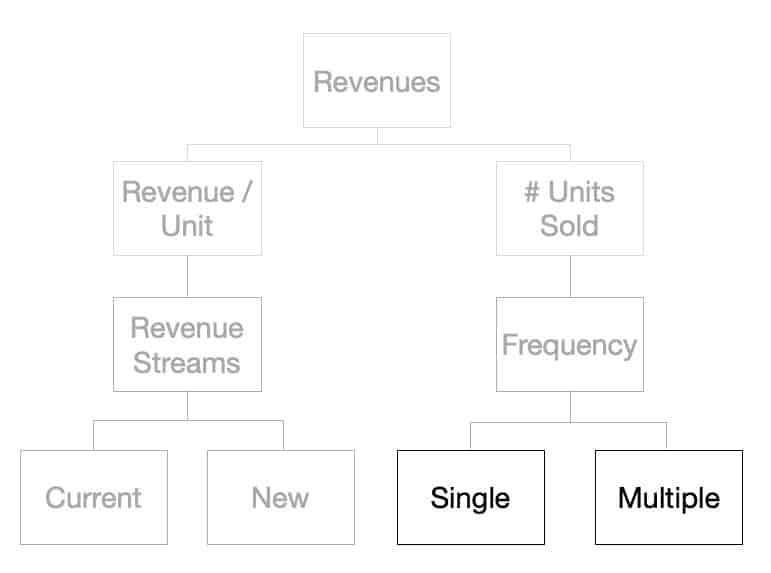

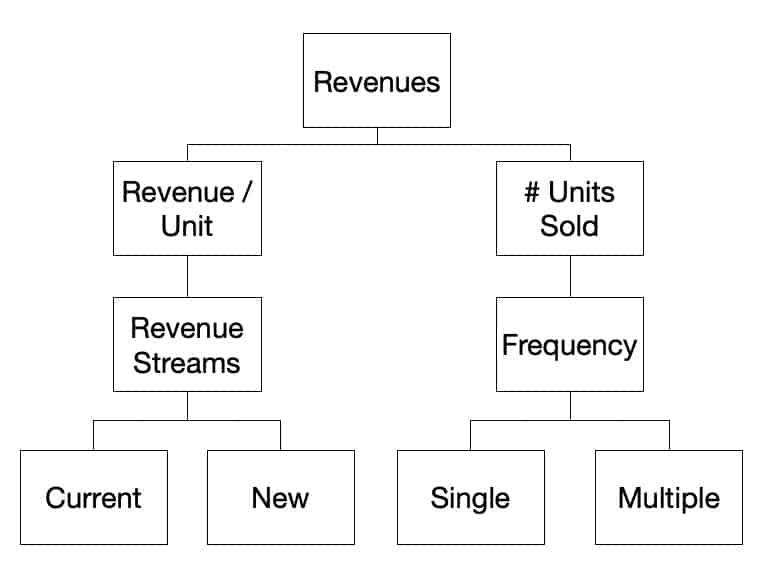

Now, let’s expand the revenue formula further.

On the left side, the primary factor that affects your revenues/sales is your revenue streams. In the previews article, I refer to these as the different segments like customer type, product lines, region/location, etc. On the other side, the primary factor that affects your quantity is the frequency of purchase.

Let’s go through each in detail.

Grow Your Revenues by Having More Revenue Streams

Revenue streams are different channels or areas where you can sell or earn money. Of course, this will be different for every business. Here are a few examples of different revenues streams:

- Sale of products

- Income from rent

- Dividends from investments

In the personal setting, this is oftentimes called income streams.

Answering the question, “where does your income/sales come from?” will help you visualize your revenue streams.

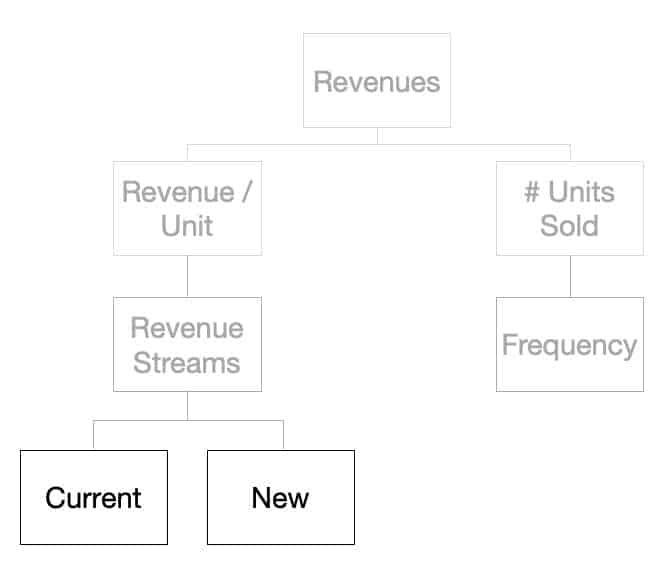

You can further generalize this into two categories:

- Current revenue streams

- New revenue streams

Your current revenues streams are where you are currently generating sales. This can be your physical store and your website. Maybe you have a sales team and someone who handles partnerships and resellers. Those are your existing or current revenue streams.

Then, of course, new revenue streams are those channels you haven’t earned from or explored at the moment.

Create a New Revenue Stream

One of the easiest way you can increase your revenues is by creating a new revenue streams. Contrary to popular belief, creating new revenue streams is simple and free in most cases.

Here are a few examples:

New Distribution Channels

For businesses selling physical items, the easiest revenue stream to capitalize on is selling on a new distribution channel. One example that comes to mind is the partnership of SM with Lazada.

Teresita Sy-Coson, daughter and vice chairwoman, said in an interview with Bloomberg, “If we can’t bring them into the store, then go to the house and sell to them.”

This move allowed SM to further increase sales without hiring more people and spending on commercial space — meaning, not having to build another mall.

Looking back now, this move makes sense. Instead of waiting for customers to go to their stores, SM can now sell to people who prefer the convenience of shopping online. Plus, if you factor in the worsening traffic condition in the city, it’s a great strategic move.

But 5 years ago, this was controversial news. Most businesses think that opening up new revenue streams will eat up their current one. While that may be true to some extent, that is not the case the majority of the time.

In fact, that’s what publishers have long said about the book industry.

“Selling eBooks will kill us.”

But that’s not true. After years and years of this talk, physical books still outsell their digital counterparts.

As long as you are providing value to your customers, your new revenue stream will not kill your existing one.

New Payment Options

Clothing retailers have long dreaded selling online. They wrongly think, as others, that this will eat up their current revenue streams. If you look at the US market, a lot of clothing retailers have closed down. This phenomenon has been dubbed as the retail apocalypse. But studies have shown that this demise is more a reflection of that particular retailer than reflecting the industry overall.

And this makes a lot of sense.

Oftentimes, companies who have established a presence and a safe market share become complacent. They fail to innovate. That’s why when new players enter the industry with something simple that every customer has already been asking/expecting, and the big players don’t provide it, they cry foul.

And in the Philippines, one of the earliest challenges faced by eCommerce merchants is the payment options. If you wanted to sell online a few years ago, the easiest would have been using PayPal. The problem was there are still a lot of Filipinos who don’t have a bank account, much more a credit card.

According to the latest research, only an estimated 22.5% of Filipinos have bank accounts. Then some estimates that those who have credit cards range only from 5-10% of the population.

That’s why offering COD or cash-on-delivery opened up a separate revenue stream for eCommerce merchants.

Again, looking back, these moves might look trivial. But a few years ago, these things were all expected by consumers but weren’t provided by businesses. But now, offering online purchases and multiple payment options have become the norm.

These are just some examples of how you can create new revenue streams easily. You just have to know your current situation, your industry, and connecting the two dots together would be easy. If you need help in that, don’t hesitate to let reach out and let me know.

The main takeaway is to focus on delivering value to your customers.

Grow Your Revenues By Focusing on Existing Customers

Now, let’s take a look at the right side of the graphic — the number of units sold.

If looking at revenue streams is the primary factor has an effect on your price, the one that affects the number of units sold is frequency.

Frequency is defined as the number of times a person purchases from you. Here are some names you are most probably familiar with:

- Once or multiple times

- One-off payments or recurring payments

- Single purchase or repeat purchases

Stop Looking for New Customers

This is one of the things I am most baffled about. Statistics show over and over again that it is easier to sell to an existing customer than to a new customer. In fact, the probability of selling to an existing customer is 60-70%, while the probability of selling to a new prospect is 5-20%.

However, the behaviors of businesses — its salespeople and decision-makers — constantly look for MORE customers. They forget about their existing customers. And this is reflected by poor onboarding/retention processes of businesses and the lack of metrics against retaining them (vs the obsession on customer acquisition).

Think about this for a second.

How many times have you made repeated purchases? Which providers or businesses? And most importantly, why do you keep buying from them?

- Your hairstylist/barber

- Uber / Grab

- Ecommerce — Lazada, Shoppee, Amazon

Of course, this does not hold true for everyone.

But for the majority of us, and most of the time, we repeatedly use them (and pay for it) because of the value that we get out of it. They are familiar and deliver exactly what we are looking for.

I have been going to the same barber for 7+ years now. I also use Uber/Grab because I don’t need to have cash with me (something that I find valuable because I hate queuing in ATMs) and I get a pretty much consistent experience throughout (greeting and confirmation when I get in, asks for destination, doesn’t complain, uses Waze for directions, and just drive). It’s just so much easier.

Yes, there’s an argument for acquiring new customers. But oftentimes, businesses neglect their existing ones. If you have a great retention rate, and continually increasing your average order value, then, by all means, focus on customer acquisition.

But if your business is only selling one-off purchases, especially if your products/services is something that is meant to be used/re-used again, then there’s something wrong.

Conclusion

Every business wants to grow its revenues. I’m sure you do. And knowing what makes up revenues (price and quantity) will help you know where to focus on.

Low-hanging fruits are opening up new revenues streams, like using another distribution channel and allowing new payment methods and increasing your repeat purchases.

In other words, focus on your customers.

Stop looking at your competitors. Don’t get distracted by internal issues. Stop worrying about whether this new strategy will work or not. Go out and engage with your customers. Continue adding value to their lives. Listen to what they say that way you can provide the best experience for them. You don’t necessarily have to apply them all, but at least, it will give you insights that you never would have if you don’t ask and listen.

Here’s a quick homework for you:

Peter Drucker once said, “What you cannot measure you cannot manage.”

I’ll leave you with something to think about…

- To increase the price — create new revenue streams

- How much of your sales should come from existing customers?

- What about those from new customers?

- Are there other markets (location or groups) that your current payment methods are alienating?

- To increase quantity — increase frequency

- Do you have a metric for customer retention and / or churn?

- Do you have dedicated account managers that help your customers find value in your products/services?

- How much value should they contribute to up-sell / cross-sell business?

Again, I’d love to hear your thoughts on this. And I do hope you find this valuable. Feel free to reach out if you want to discuss this further.