Running a business is hard. Whether you’re a 1-man team or running a 10,000-organization, it can get pretty complicated.

As an employee, you didn’t have to worry too much about other stuff other than your job. But as a business, you have to deal with them even if you don’t like it — financials, taxes, efficiency, tools and apps, and other decisions you just weren’t exposed to before.

But did you know there is a very simple way to manage your entire business? This magic formula that I’m going to share will allow you to look at the health of your business objectively.

Ready now? Here it is…

Profits equal revenues minus costs.

Profits = Revenues – Costs

Preparatory Points

But first, I recommend reading the real purpose of businesses. Why? Because what I will share here is a result of delivering value to your customers. What that means is before we talk about sales or revenues, you have to understand where it comes from and why customers buy.

Without that understanding, it’s easy to get lost in the world of business and its complexities.

So, go on and take a few minutes to read the article. You can always go back to this one anyway.

Done? Great.

The Profitability Framework

Let me share a very simplified approach to business that will weed out all distractions. Let’s go back to our magic formula:

Profits = Revenues – Costs

In consulting, this formula is called the profitability framework. It’s pretty self-explanatory but a very powerful tool when used correctly — which I’ll share later below.

For now, let’s define each part first:

- Profits are what’s left after you deduct all your expenses from the revenues you earned in any given period.

- Revenues are the sales from your customers. It’s the sum of all payments made to your at ay given period.

- Costs are the total expenses your business incurred during a period. This includes salaries, rent, etc.

Simple, right?

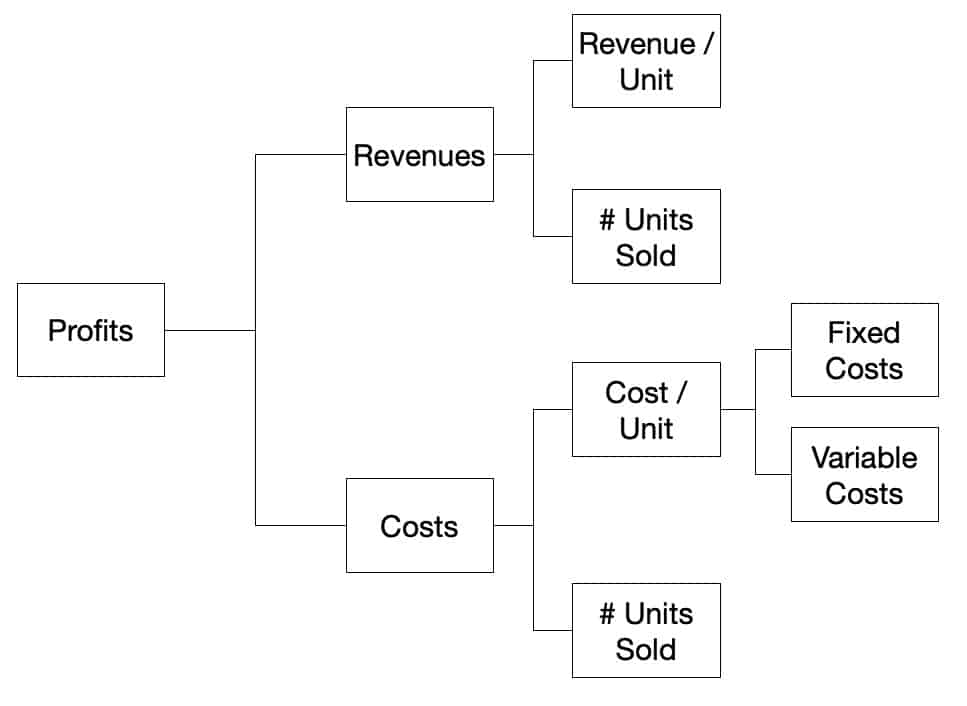

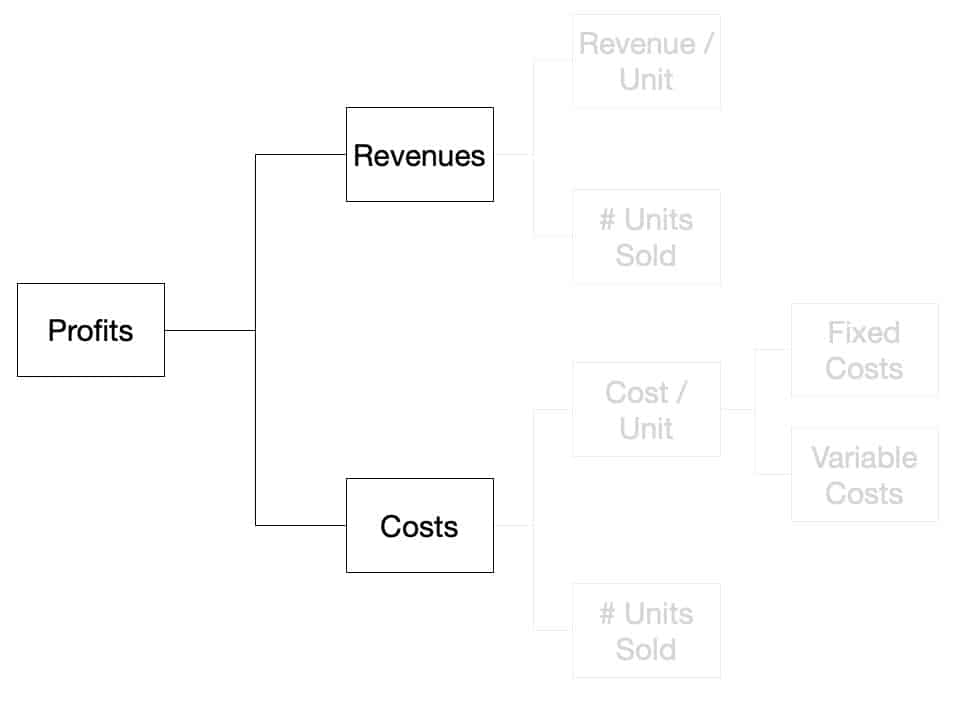

Now, let’s look at the profitability framework from another perspective.

This is an expanded version of the profitability framework. Don’t worry if it looks a bit confusing. This will all make sense in a minute.

Let’s break it down.

Big picture thinking using the profitability framework

One of the key benefits of using the profitability framework is figuring out why something happened. Oftentimes, we are so busy running the business that you don’t take time to analyze what’s really going on and what’s causing it. This simple, magic formula will help you with that.

By looking at your profits and its components (revenues and costs), you would know how your business is doing. No complications.

If it’s positive, then you’re doing okay. If it’s negative, then you’re not doing okay.

At least at first glance.

By just using these metrics, you would have an idea of what you should keep doing, and what changes you need to make.

But let’s take it further.

We now know the what, but we don’t know the why.

You can segment your data and compare it with other time frames. For example, you want to look at this month’s performance versus last month. Did profits this month went up or down? Is that good or not? Why did it change?

(I also shared more about the three most common segmentation techniques you can use with the profitability framework below.)

Let’s take a look at the components that contribute to the revenues and costs. This will give you an answer to the why.

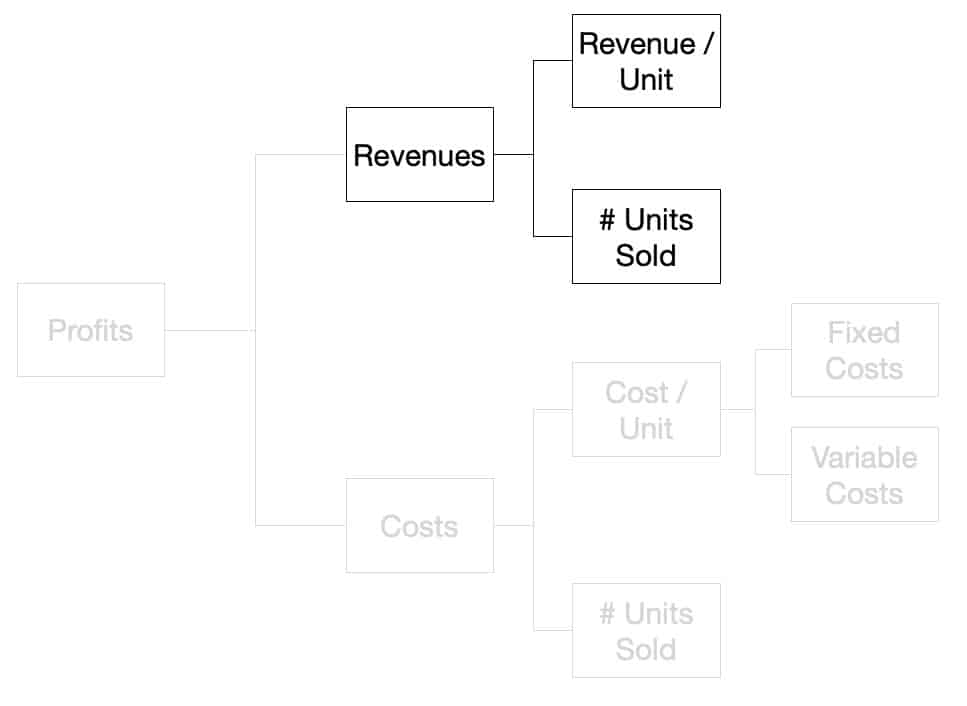

Analyzing the revenue side for the formula

Revenues are made up of two factors:

- Unit price

- Quantity sold

Looking at this mathematically, revenues is the product of the unit price and the number of items sold.

Revenues = Unit Price x Quantity Sold

Let’s take a look at Apple. Let’s assume they only sell the iPhone 11 and only one model. They sell it for $699. Last month, they sold 500,000 pieces.

That would make Apple’s total revenues last month at $349,500,000.

(Again, I’m making this simple by using only one number. An advanced way to analyze this is to look at the unit price and quantity sold per channel, per item, and look at different time periods so you see trends.)

In reality, Apple has multiple product lines like Macs, iPads, and other accessories. Within each product line, they have different models/versions like in the iPhone example, they have the 64Gb/128Gb/256Gb models. Each of those models, you have different color offerings as well.

Segmenting each part of the revenue formula gives you a better understanding of what’s really causing the what.

In our example, Apple sold $350m last month. Is that a good thing?

You might say, “If revenues went up, that should always be a good thing right? I made more sales. How can that be a bad thing?”

Not so fast.

The revenue side is just one part of the equation. You also have to understand the cost side. Allow me to explain.

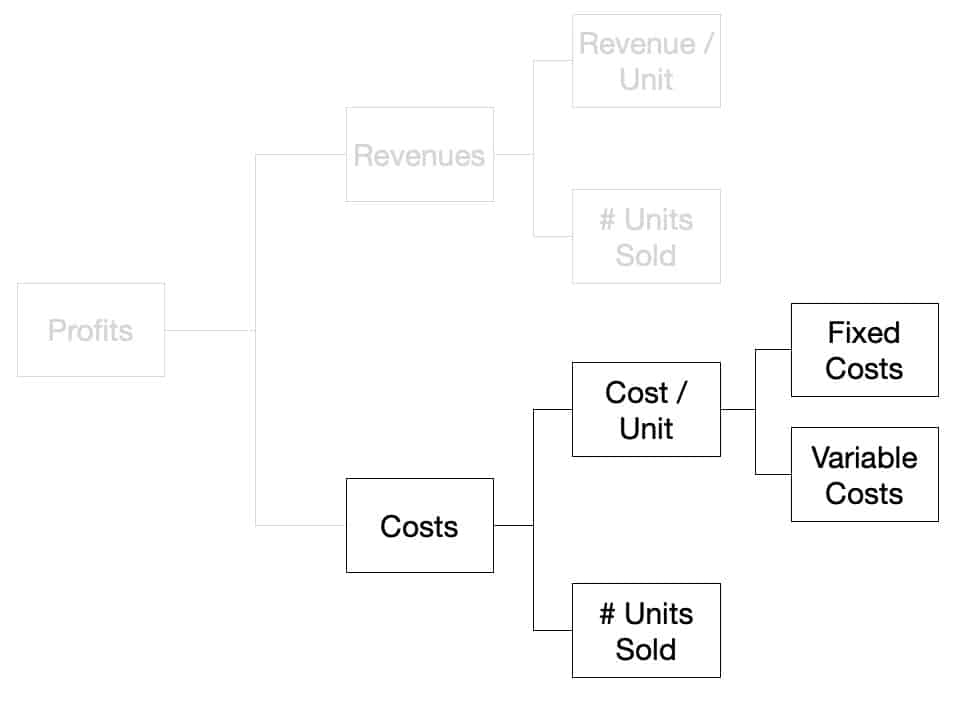

Analyzing the cost side for the formula

Costs are your total expenses for the same period. It’s made up of two factors as well:

- Unit cost

- Quantity

Unit cost can also be broken down into fixed and variable costs.

- Fixed costs are incurred whether or not you made the sale.

- Variable costs are those expenses associated directly with the sale.

Let me explain these two concepts quickly:

You sell fruit shakes at a kiosk stand at the mall. Your fixed costs would be rent and salaries because even if you don’t make a single sale, you still have to pay them. Then, your variable costs would be the cost of the ingredients you used. If you advertise, then that’s a fixed cost too.

Again, when you apply some segmentation here, you would get a richer analysis. But that’s not what this article is about.

Analyzing performance using the profitability framework

In our Apple example, we left a question about whether or not the increase in revenue to ~$350m by Apple is a good thing.

The first thing to do is to look at the formula as a whole and ask these questions:

- Did costs increase, decrease, or stayed the same?

- Did profits went up, down, remained flat?

- What caused the changes? Which product line? Which version? Which model contributed the most?

As you can see, using the profitability framework allows you to do all kinds of analysis. Knowing this formula by heart allows you to identify what is happening in your business.

Let’s take a look at another example below…

- Profits declined by 20% this year. What caused it? Why did it happen?

- If your sales decreased by 20%, that’s the answer.

- But which part of sales?

- Did you sell less this year than last year?

- Or did your selling price went down?

- But which part of sales?

- But what if your sales increased 10%, yet profits went down 20%?

- If it increased, then your expenses would have skyrocketed by at least 30%.

- Again, which part of expenses?

- Is it your fixed costs or your variable costs?

- If it increased, then your expenses would have skyrocketed by at least 30%.

- If your sales decreased by 20%, that’s the answer.

Segmentation Analysis

Now, if you use this framework with segmentation or “slicing and dicing” of data, you will gain huge insights like I alluded earlier.

There are multiple ways to segment, but the most common are these:

- Time (daily, weekly, monthly, quarterly, yearly, etc.)

- Location (branches, regions, countries, etc.)

- Channels (walk-ins, phone, online, etc.)

- Product line (desktops, laptops, phones, accessories, etc.)

- Models/SKUs (64Gb, 128Gb, 256Gb, etc.)

Using the example in the previous section, your profits declined 20% and yet sales increased by 10%. After you segment the numbers further, you found out the Branch A’s sales remained steady. Branch B grew by 10%.

Now you know what’s causing the sales increase.

But that doesn’t solve what caused profits to decline.

When you apply the same principle on the costs side, you found out that Branch B’s expenses grew by 40%. Now, you have a more informed decision that Branch A is performing well despite the steady sales, while Branch B, despite contributing to increased revenues, is actually the one causing the decline in profitability.

Why Is This the Only Formula You Need to Master?

The single, biggest reason why this is the only formula you need to master is this: any organization will cease to exist if its profits are below zero for an extended period of time.

By looking at this formula alone clears all distractions.

Today, too many businesses are focused on shiny and exciting things that they often forget the basics. They are focused on getting investments, exits, IPOs, and all the other things you hear in the news. While nothing is wrong with those, you have to understand this in the original context of business — are you driving value to your customers?

Instead of spending your resources on those things, focus on this single formula and what it means for your business. It will give you an objective perspective of where you are right now and what you need to do.

At the end of the day, the only number that matters is profits. If you have profits as a business, it means you created value for your business and for your customers.

If for a prolonged period of time, your profits are below zero, you will close up shop. You are not creating customers. That means you are not delivering value.

If you are so down in the weeds monitoring the hundreds of metrics in your organization, yet fail to look at this very important number, it might be too late to pivot or to change your strategies.

If you are in this situation right now (which I certainly hope not), it’s time to rethink how your business delivers value to your customers. Whether your profits are positive or negative, take time to compare it with historical data. Segment it. Know which segment of the business is helping you create more value and which ones aren’t. Decide whether to continue with this strategy or not.

One tool I recommend using is the buyer utility map. It helps you find opportunities across the buying experience cycle that you and your competitors might have overlooked.

Don’t get lost in the complexities of running a business. Focus on a the basics first.